tax forfeited land morrison county mn

Morrison County Property Taxes. Convenience fee on credit card transactions is 235.

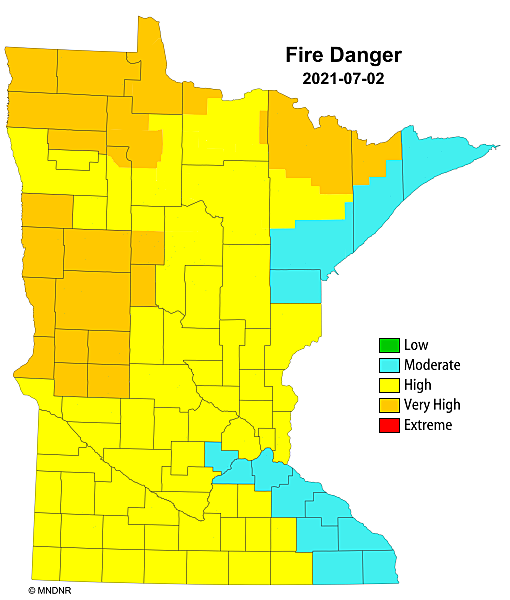

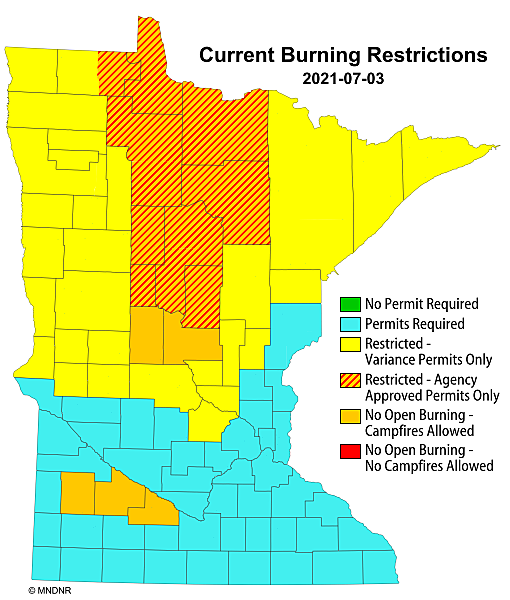

Limited Fireworks Restrictions For Todd Morrison Counties This

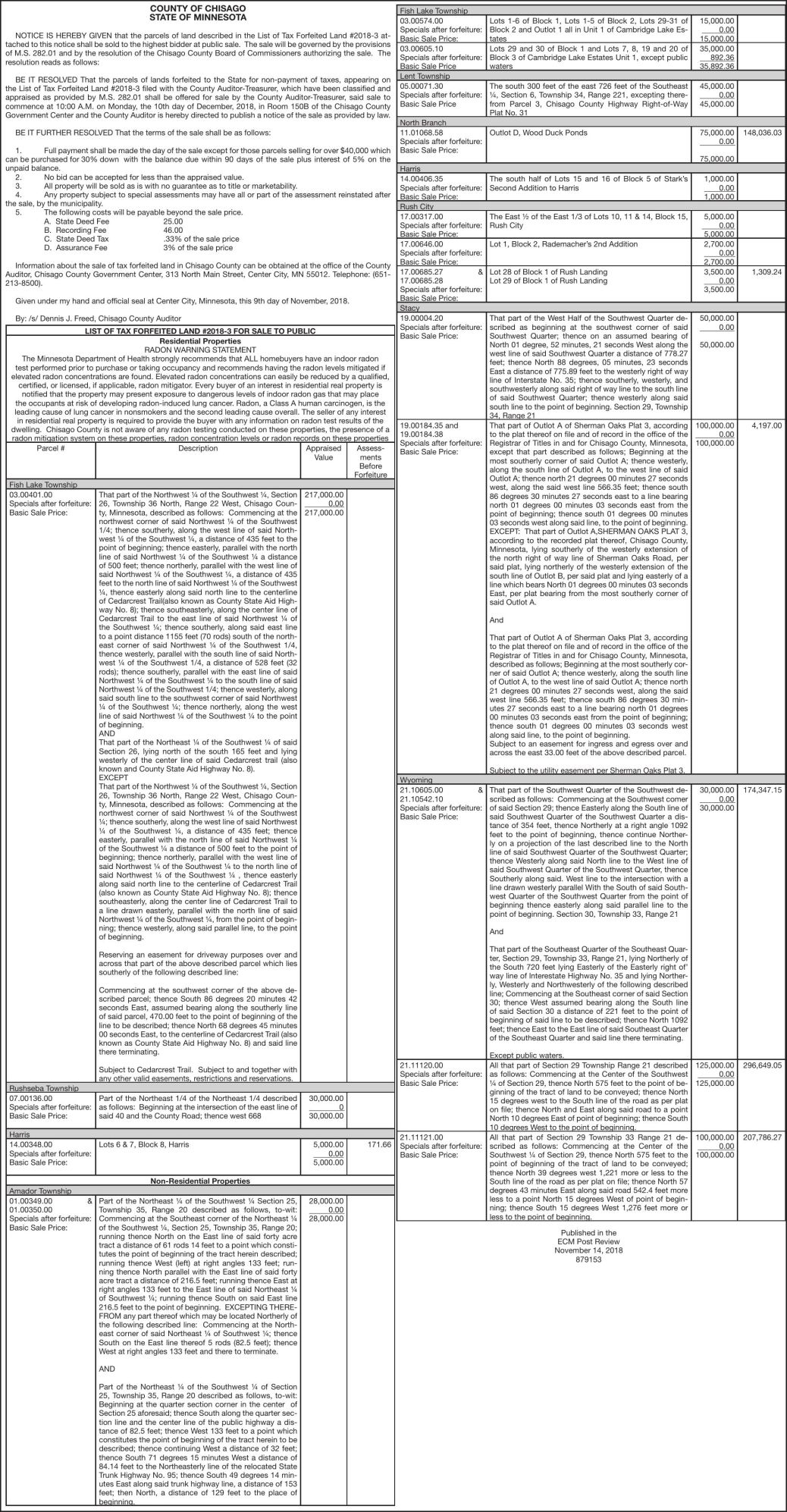

In addition to the purchase price of the land the following extra fees and costs are due at the time of sale.

. Morrison County MN Land. If you are interested in purchasing tax-forfeited land please contact the county auditor or county land department in the county in which the land is located. Itasca County 123 NE 4th Street Grand Rapids MN 55744 Phone.

Morrison County Assessment Form. A public auction of tax forfeited property was held on July 27 2022. Basil Rd Swanville MN 56382.

A Notwithstanding Minnesota Statutes sections 9245 103F535 and 282018 Morrison county may sell the tax-forfeited land bordering public water or wetlands that is. Property Tax Programs Applications. 8 am to 430 pm.

Enter an email address to sign in or subscribe to Morrison Countys Website. Tax-forfeited land managed and offered for sale by St. W Walker MN 56484.

800-422-0312 Report website problems to helpdeskcoitascamnus. Under Notify Me choose the methods you would like to be notified by. A 3 surcharge for the state assurance account.

Phone 218547-7247 Fax 218547-7278. Any questions should be directed to the. Tax forfeited parcels are properties on which delinquent property taxes were not paid title to the land and buildings was forfeited and title is now vested in the State of.

Jail Inmate List. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of. Internal data records over 30 million of rural properties and land for sale in Morrison County Minnesota.

These land listings represent some 1858 acres of rural land and property for sale. 218-327-7363 Toll Free. Notice of Tax Forfeited Land Sale Join Morrison_County on Nov.

5th at 10 am in the County Board Room of the MorrisonCounty Courthouse for a Tax Forfeited Land Sale. Find your county offices using the. If a property does not sell at auction it may be available over.

The following parcels did not sell and are currently available for purchase over the counter at the Mower. MLS ID 6218940 CENTRAL MN REALTY LLC. View Cass County information about tax forfeited land.

A state deed fee. Tax-forfeited properties are sold at public auction periodically as salable parcels become available. The Meeker County Terms of Sale PDF explains the terms of sale when purchasing tax forfeited property in Meeker County.

Tax forfeited parcels are properties on which real estate taxes were not paid title to the land and buildings was forfeited and they are now vested in the State of Minnesota. Interested buyers may also contact Land Services staff at 218-824-1010 or email Land Services for more information. Benton County Government Center 531 Dewey Street PO.

For debit card the fee is 235 with. Box 129 Foley MN 56329 Phone. 213 1st Avenue SE Little Falls MN 56345.

Properties offered for sale have forfeited to the State of.

House Circa 1855 To Be Auctioned Oct 18 News Southernminn Com

Property Tax Morrison County Mn

Aitkin County Looking At Vcet Group With Itasca Mille Lacs Mille Lacs Messenger Messagemedia Co

Property Tax Morrison County Mn

Crow Wing County Board Updated Forestry Management Plan Approved Brainerd Dispatch News Weather Sports From Brainerd And Baxter

Limited Fireworks Restrictions For Todd Morrison Counties This

News Flash Morrison County Mn Civicengage

Candidates For Morrison County Auditor Treasurer Answer Record S Questionnaire Community Hometownsource Com

Limited Fireworks Restrictions For Todd Morrison Counties This

Minnesota Tax Sales Tax Deeds Tax Sale Academy

Voter S Guide Morrison County Brainerd Dispatch News Weather Sports From Brainerd And Baxter

Tax Forfeited Land Lyon County Mn

Potlatch Selling 10k Acres In Hubbard County Park Rapids Enterprise News Weather Sports From Park Rapids Minnesota